UK water sector ratings outlook downgraded from stable to negative

- January 15, 2018

- Posted by: administrator

- Category: Investment and Finance, Europe

Ratings agency Moody’s has changed its outlook for the UK water sector from stable to negative for the first time since first published in 2004.

In a report published today Moody’s says that the Water Services Regulation Authority’s (Ofwat) proposed cut in UK water companies’ allowed headline returns by a third from 2020 will weigh heavily on the credit metrics of many firms and underpins the negative outlook on the sector over the next 12 to 18 months.

Stefanie Voelz, Vice President — Senior Credit Officer at Moody’s commented:

“While UK water companies will review their financial and dividend policies in light of the probable cut in returns, some may ultimately be unwilling or unable to maintain their current credit quality.”

According to Moody’s the price review, which will conclude in December 2019 (PR19) and will set tariffs for the period from April 2020 to March 2025 (AMP7), is likely to result in lower allowed returns for companies. The regulator has guided towards a headline rate of 2.3% as compared to the current 3.6% for the wholesale activities.

While the proposed (partial) change of inflation indices will benefit companies’ cash flows, this will be at the expense of future growth of the regulatory capital value (RCV).

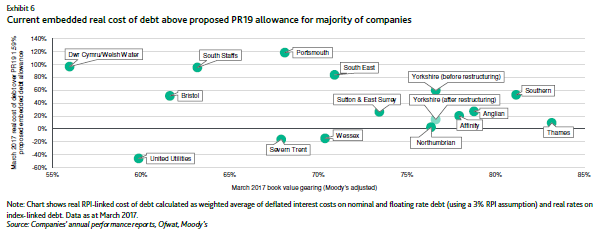

The ratings agency is warning that highly geared firms with expensive, long-dated and/or small debt portfolios remain most at risk, but the sector as a whole will face pressure.

In addition, growing competition on upstream as well as downstream activities will increase the sector’s business risk in the medium- to long term, although most of the impact may not be felt before 2025.

Companies’ borrowing costs will reduce over the period as they refinance at lower rates, but Moody’s said that most will likely underperform the future cost of debt allowances, creating pressure on interest coverage metrics.

Lower returns and more volatile cash flows from enhanced incentives may also require adjustments to capital structures and balance sheet strengthening if credit quality is to be maintained.

Solid sector performance will likely continue until the end of the current period in March 2020, but will not be sufficient to offset the pressure of low returns.

On average the sector achieved a return on regulatory equity of around 6.3% over the first two years of the current regulatory period, in excess of the allowed 5.6% base return, with performance against total expenditure targets being the biggest driver.

However, as expenditure and performance targets will likely tighten from April 2020, outperformance potential for the average company will reduce.

Click here to access the report as a subscriber or purchase as a non-subscriber